Loading

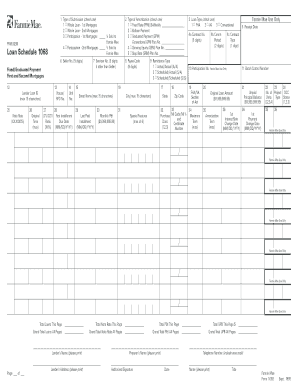

Get Form 1068

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1068 online

This guide provides detailed instructions on how to complete the Form 1068 online, ensuring that users understand each section and field. Whether you are a seasoned user or new to digital document management, this guide is designed to support you through the process.

Follow the steps to successfully complete Form 1068 online.

- Click ‘Get Form’ button to obtain the form and open it in the editing interface.

- Select the type of submission by checking one of the options: Whole Loan - 1st Mortgages, Whole Loan - 2nd Mortgages, or Participation types, indicating the percentage sold to Fannie Mae if applicable.

- Enter the lender’s loan ID, which should not exceed 15 characters, and provide the note rate as a percentage format (XX.XXXX%).

- Fill in the original term in months and specify the type of amortization by checking the corresponding box like Fixed Rate, Balloon Payment, Graduated Payment, or others as needed.

- Complete the lender and servicer numbers using the 9-digit format, followed by the house or RFD number, street name, city, state, and zip code.

- Input the loan type by selecting from options such as FHA, VA, or Conventional, then fill in the contract number, common period, and receipt date.

- Provide the unpaid principal balance and original loan amount, ensuring to keep the amounts in the specified format.

- Collect totals for loan count, interest rate, P&I, and unpaid balance at the bottom of the schedule and submit the grand totals on the first page only if multiple schedules are used.

- After completing the form, save your changes, download a copy, print it, or share the document as required.

Complete your documents online for a seamless experience.

Form 8868 is an IRS application for an automatic extension to file an exempt organization return. It is crucial for non-profit organizations needing extra time to prepare their tax documents, including related forms like Form 1068. By filing this form correctly, you can avoid penalties that arise from late submissions. To simplify this process, explore the resources available at US Legal Forms for guidance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.