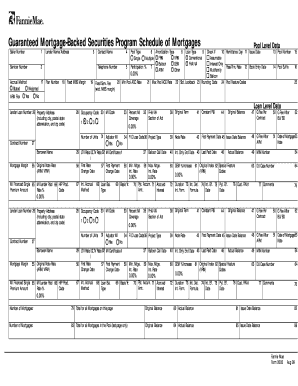

Get Schedule Of Mortgages (form 2005): Pdf - Fannie Mae

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Schedule Of Mortgages (Form 2005): PDF - Fannie Mae online

Filling out the Schedule Of Mortgages (Form 2005) is an essential step in the mortgage-backed securities process. This guide will provide you with clear instructions on how to complete this form accurately for successful submission.

Follow the steps to effectively complete the Schedule Of Mortgages (Form 2005)

- Click the ‘Get Form’ button to obtain the schedule and open it in your preferred editor.

- Start by filling in the seller and servicer numbers at the top of the form. Ensure you use the correct numbers as assigned to your organization.

- Enter the lender's name and address in the designated fields. Accuracy is crucial to avoid delays in processing.

- Provide the contact name and telephone number for inquiries or follow-up related to the information provided in the form.

- Select the appropriate pool type and amortization type from the options available. You may choose between variable-rate mortgage (VRM), fixed-rate mortgage (FRM), and other types.

- Fill in the participation percentage for each mortgage listed, ensuring that the total is accurately reflected.

- Provide details on loan type, remittance day, pass-thru rates, and any relevant features. Complete any additional fields as required.

- For each mortgage listed, include the property address, occupancy code, number of units, borrower name, and mortgage details such as original balance, note rate, and loan type.

- Verify all calculated fields, such as LTV ratios and MI coverage, ensuring they match your records.

- Once you have filled out all required sections, save your changes. You can then choose to download, print, or share the completed form as necessary.

Complete your Schedule Of Mortgages (Form 2005) online today to facilitate a smooth mortgage-backed securities transaction!

If you are 30 days late on your mortgage payment, several consequences may follow. Your lender will likely report the late payment to credit agencies, which can negatively impact your credit score. Additionally, you might incur late fees, and if the payment remains unpaid, your account could become subject to further action. Utilizing tools like the Schedule Of Mortgages (Form 2005): PDF - Fannie Mae can help you understand your mortgage obligations better and prevent delinquency.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.