Loading

Get Alabama Form Ppt 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Alabama Form Ppt 2013 online

Filling out the Alabama Form Ppt 2013 can be a straightforward process if you follow the correct steps. This guide aims to provide clear and supportive instructions for users, ensuring all required information is accurately completed online.

Follow the steps to complete the Alabama Form Ppt 2013 accurately.

- Click 'Get Form' button to acquire the form and open it in your preferred online editor.

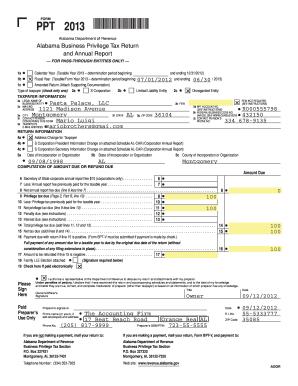

- Select the appropriate taxable year by choosing either calendar year, fiscal year, or if applicable, check amended return to attach supporting documentation.

- Indicate the type of taxpayer by selecting one option such as S Corporation, Limited Liability Entity, or Disregarded Entity.

- Fill in the taxpayer information fields, including the legal name of the business entity, mailing address, and identification numbers such as FEIN and BPT account number if applicable.

- Provide return information, including any address changes and details regarding incorporation, such as the date, state, and county of incorporation.

- Complete the computation of amount due or refund due by calculating fees, taxes, penalties, and interest as per the guidelines provided on the form.

- Review all entries for accuracy before signing. Ensure that you authorize the Department of Revenue to communicate with your tax preparer if necessary.

- Finalize your filing by saving your changes, and choose whether to download, print, or share the completed form as needed.

Start completing the Alabama Form Ppt 2013 online today!

All businesses operating in Alabama, including corporations and partnerships, must file an Alabama privilege tax return. This includes anyone engaging in business activities or holding assets in the state. The Alabama Form Ppt 2013 is the document required for this filing. Make sure to review the specific guidelines to determine your filing requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.