Get Boe 64 Ses

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Boe 64 Ses online

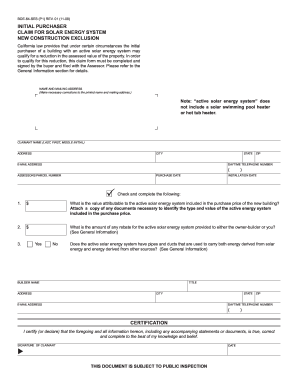

The Boe 64 Ses form is essential for initial purchasers seeking a reduction in assessed property value due to an active solar energy system. This guide provides step-by-step instructions to help users complete the form online accurately and effectively.

Follow the steps to complete the Boe 64 Ses online form.

- Press the ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Review the pre-printed name and mailing address on the form. Make any necessary corrections to ensure they are accurate.

- Enter your name in the 'Claimant Name' field, including your last name, first name, and middle initial.

- Fill in your complete address, including city, state, and zip code.

- Provide your email address and daytime telephone number for communication purposes.

- Input the Assessor's Parcel Number as required.

- Indicate the installation date of the solar energy system.

- Record the purchase date of the building.

- In the section asking for the value of the active solar energy system included in the purchase price, enter the appropriate dollar amount and attach any necessary documentation.

- Next, indicate the amount of any rebate received for the system.

- Respond to the question regarding whether the solar system has pipes and ducts carrying energy from both solar and other sources.

- Complete the builder's name and address information if applicable.

- Sign and date the certification statement to affirm the accuracy of the information provided.

- Finally, save your completed form, and choose to download, print, or share it as needed.

Complete your Boe 64 Ses form online today to benefit from potential property tax reductions.

Property tax exemptions can arise from various circumstances, often reflecting the property's use or ownership. For instance, properties owned by non-profit organizations or those designated for low-income housing may qualify for exemptions. Additionally, certain veterans and seniors can benefit from property tax relief programs. Understanding these exemptions can be crucial, and using tools like BOE 64 SES can guide property owners through the process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.