Get Collegesavingsmd

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Collegesavingsmd online

This guide provides clear instructions on how to effectively fill out the Collegesavingsmd form for requesting a refund or reduced refund from the Maryland Prepaid College Trust. Following these steps will help ensure a smooth process.

Follow the steps to complete your Collegesavingsmd refund request

- Click ‘Get Form’ button to access the Collegesavingsmd refund request form and open it in your preferred document editor.

- Carefully read the instructions provided at the beginning of the form, including details about refunds and tax considerations. It is advisable to consult a tax advisor if needed.

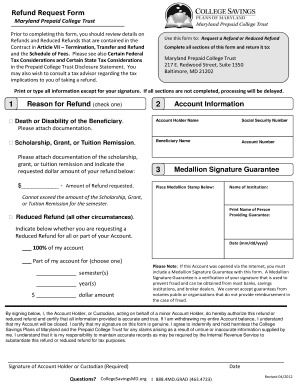

- Select the reason for the refund by checking the appropriate box. Options include 'Death or Disability of the Beneficiary' or 'Scholarship, Grant, or Tuition Remission.' Attach any relevant documentation as required.

- Fill in the 'Account Information' section with necessary details, including the account holder's name, social security number, beneficiary's name, and account number.

- Indicate the amount of the refund you are requesting in the specified field. This should not exceed any attached documentation regarding scholarships or grants.

- If requesting a reduced refund, specify whether it is for 100% of your account or part of your account. Provide details on the number of semesters or years involved and the total dollar amount.

- Secure a Medallion Signature Guarantee, if necessary, by obtaining it from a bank or a similar institution. Ensure it is placed in the designated area on the form.

- Sign and date the form as the account holder or custodian. Ensure your signature is genuine and that all information is accurately completed.

- Submit the completed form by mailing it to the Maryland Prepaid College Trust at the specified address. Make copies for your records before mailing.

- After submission, you have the option to save changes for your personal records, print a copy, or share the form as needed.

Complete your Collegesavingsmd refund request form online today to ensure a timely response.

To report your 529 contributions on your taxes, begin by gathering all relevant documentation for your contributions. You typically state these amounts on your federal tax return, since they may affect your taxable income. Additionally, refer to the specific guidelines set by Collegesavingsmd for Maryland residents, as local rules may apply. If in doubt, use reliable platforms like uslegalforms to simplify the reporting process and ensure compliance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.