Loading

Get Kubota Credit Score Requirements

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Kubota Credit Score Requirements online

Filling out the Kubota Credit Score Requirements is a crucial step in securing financing for your equipment needs. This guide provides clear instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the form.

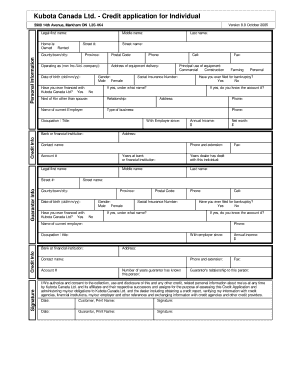

- Click ‘Get Form’ button to access the form and open it in the editor.

- Start by providing your legal first name and middle name in the specified fields. Ensure that the information matches your official identification.

- Select your home type by indicating whether you own or rent your residence.

- Fill in your street number, street name, county/town/city, province, and postal code. This information helps in verifying your residence.

- Provide your date of birth in the format of day/month/year, followed by your phone number and fax number.

- Identify the principal use of the equipment you are applying for, selecting either commercial or construction.

- Input your social insurance number and details about your next of kin other than your partner. Be sure to mention their relationship to you.

- Indicate your type of business and provide relevant details like your address, phone number, and years at the bank or financial institution.

- Enter your annual income and provide contact information for your bank or financial institution, including the name and phone number of a contact person.

- Proceed to the guarantor information section; enter their legal first name, last name, and other requested details. Include any pertinent information regarding your relationship with the guarantor.

- Complete the credit information section, including any history of bankruptcy and your current occupation. Provide the names of your current employer and contact details.

- Review all sections for accuracy before signing. Ensure that you and your guarantor each print your names and provide signatures along with the date.

- After reviewing the filled form, save your changes. You may choose to download, print, or share the completed application as needed.

Complete your Kubota Credit Score Requirements online today to ensure a smooth financing process.

To finance a Kubota tractor, your credit score typically needs to meet specific Kubota credit score requirements. Generally, a score of 650 or higher is favorable for obtaining financing. However, other factors, such as your income and credit history, may also influence your eligibility. Knowing these requirements helps you plan effectively before making your tractor investment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.