Get Chapter 61a Application - Town Of Sherborn Massachusetts - Sherbornma

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Chapter 61A application - Town of Sherborn Massachusetts online

Completing the Chapter 61A Application for the Town of Sherborn, Massachusetts involves a systematic approach to ensure accurate submission. This guide provides clear, step-by-step instructions for filling out the application online, making the process accessible for all users, regardless of legal experience.

Follow the steps to complete your application accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

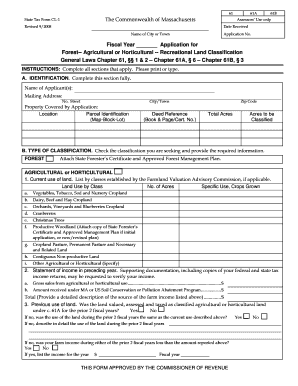

- Fill out the identification section completely. Provide your name, mailing address, and the property covered by the application, including the parcel identification and total acres.

- In the type of classification section, check the classification you are seeking (forest, agricultural/horticultural, recreational) and provide any necessary additional documents, such as the State Forester’s Certificate if applicable.

- For agricultural or horticultural classification, detail the current use of the land by listing the specific crops grown and the number of acres for each use. Include any required income documentation.

- State the previous use of the land and confirm if it was classified in the prior two fiscal years.

- If applicable, complete the lessee certification by having each lessee sign the statement regarding the land's use.

- All owners must sign the signature section ensuring that the application and accompanying documents are true and complete.

- Once all information is filled out and verified, save changes, and choose to download, print, or share the completed form.

Get started on your application and complete your documents online today.

The Chapter 61 program in Massachusetts encompasses several statutes that provide tax incentives for landowners maintaining open space for agricultural or forestry purposes. By participating in this program, landowners can lower their property tax burden while contributing to the preservation of scenic landscapes. If you're interested in the Chapter 61A Application in the Town of Sherborn Massachusetts, uslegalforms can help you with the necessary documentation and ensure you meet all requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.