Loading

Get Reg 1e Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Reg 1e Form online

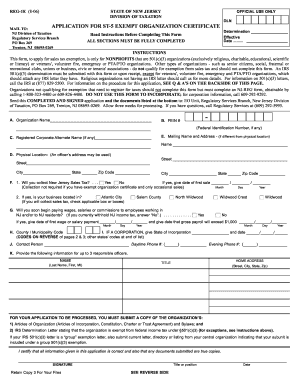

Filling out the Reg 1e Form online is a crucial step for nonprofit organizations that seek sales tax exemption in New Jersey. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to successfully complete the Reg 1e Form online

- Use the ‘Get Form’ button to access the Reg 1e Form. Once you click the button, the form will open in your online editor.

- In Section A, enter the organization name and, if applicable, the Federal Identification Number. Ensure that all fields are filled correctly.

- Complete Section B by entering the FEIN number. If your organization does not have one, you can leave this section blank.

- In Section C, provide the Registered Corporate Alternate Name if your organization has one. If not, skip this step.

- Fill in Section D with the physical address of your organization. If the mailing address is different, provide that in Section E.

- For Section F, answer whether your organization will collect New Jersey Sales Tax. If yes, include the date of the first sale in the specified format.

- Proceed to Section G to indicate if your organization will begin paying wages to employees in New Jersey. Provide the required dates if applicable.

- Complete Section H by entering the County/Municipality Code. Refer to the list included in the form to find the correct code based on your organization’s location.

- If applicable, disclose the State of Incorporation and the incorporation date in Section I.

- In Section J, add the contact person’s name and daytime and evening phone numbers to ensure easy communication.

- Provide information for up to three responsible officers in Section K, including their names, home addresses, and titles.

- Before submitting, certify that all information on the application is correct and that attached documents, such as the Articles of Organization and IRS Determination Letter, are true copies.

- Finally, review the filled form carefully. You can then save your changes, download a copy, print it, or share it as needed.

Start completing your Reg 1e Form online today to ensure your organization's sales tax exemption.

To fill out a certificate of exemption, start with your personal or business information on the Reg 1e Form. Clearly indicate the reason for the exemption, providing any necessary supporting documentation. Review your entries for accuracy before submitting, as proper completion ensures your exemption claim is valid.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.