Loading

Get Fillable Form O 255

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fillable Form O 255 online

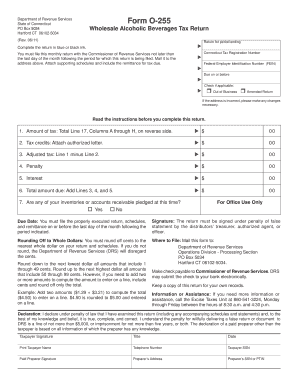

This guide offers clear and comprehensive instructions on how to complete the Fillable Form O 255, the wholesale alcoholic beverages tax return. Whether you are new to tax filing or have experience, you will find this guide helpful in navigating the process online.

Follow the steps to successfully complete and submit your form.

- Press the ‘Get Form’ button to download the Fillable Form O 255 and open it in your preferred document editor.

- Begin by entering the return period's ending date along with your Connecticut Tax Registration Number and Federal Employer Identification Number (FEIN). Be certain these details are accurate.

- Indicate the due date for submission, which is the last day of the month following the period for which you are filing. Check any applicable boxes, such as 'Out of Business' or 'Amended Return'.

- Fill in the amount of tax calculated as the total from Line 17, Columns A through H on the back of the form, ensuring to enter the correct dollar amount.

- If you have any tax credits, be sure to attach the authorized letter and enter the amount on the tax credits line.

- Calculate the adjusted tax by subtracting the tax credits from the tax amount and enter this figure.

- If penalties or interest apply, ensure to list those amounts as instructed.

- Add the adjusted tax, penalties, and interest to arrive at the total amount due and enter this number.

- Indicate whether any inventories or accounts receivable are pledged by selecting 'Yes' or 'No'.

- Review the form for completeness, ensuring all sections are filled correctly.

- Save changes to the completed form, and then download, print, or share the form as necessary for submission.

Complete your Fillable Forms online today to ensure timely and accurate submissions.

Related links form

To download tax forms, visit the IRS website or dedicated platforms like US Legal Forms. Simply look for the specific form you need, such as the Fillable Form O 255, and hit the download link. This straightforward process allows you to have the forms on hand whenever you need them.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.