Loading

Get Ar8453 Ol 2012 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ar8453 Ol 2012 Form online

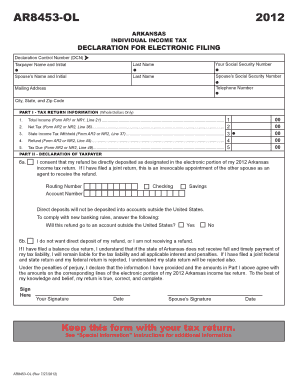

The Ar8453 Ol 2012 Form is essential for declaring your electronic filing for Arkansas individual income tax. This guide provides clear, step-by-step instructions to help you easily complete the form online.

Follow the steps to complete the Ar8453 Ol 2012 Form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Fill in your taxpayer name and initials in the specified fields, along with your Social Security number. Ensure the information is accurate to avoid delays.

- Provide your spouse's name, initials, and Social Security number if applicable. Double-check to ensure all names and numbers are entered correctly.

- Enter your telephone number and complete your mailing address, including city, state, and zip code.

- In Part I, input the total income, net tax, state income tax withheld, refund amount, and tax due as per the specified lines from your tax return forms.

- In Part II, choose whether to consent to direct deposit of your refund by marking the appropriate box and providing the routing and account numbers.

- If you do not wish to receive a direct deposit, select the appropriate option under Line 6b.

- Sign and date the form in the designated areas, ensuring your spouse also signs if filing jointly. Retain a copy of this form with your tax return.

- After completing the form, save your changes. You may now download, print, or share the completed document as needed.

Complete your documents online with confidence and stay organized.

Tax form 8453, especially the Ar8453 Ol 2012 Form, is used to authenticate your electronically filed tax return. It ensures that your submission is legitimate and allows the IRS to accept your e-filed documents. Utilizing this form helps streamline the tax filing process, making it easier for you to file your taxes online.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.