Loading

Get 720xxcom Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 720xxcom Form online

Filling out the 720xxcom Form online is an essential process for corporations wanting to report changes to their income tax returns accurately. This guide will provide clear, step-by-step instructions tailored for users of all experience levels.

Follow the steps to effectively complete the 720xxcom Form.

- Press the ‘Get Form’ button to obtain the 720xxcom Form and open it in your preferred online editor.

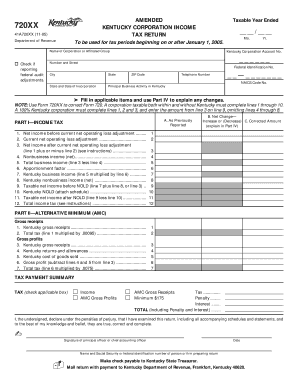

- Begin by entering the taxable year ended in the designated fields, ensuring to fill in both month and year correctly.

- Fill in the corporation's name or the name of the affiliated group accurately in the provided space.

- Indicate if you are reporting federal audit adjustments by checking the appropriate box.

- Complete the Kentucky Corporation Account Number and Federal Identification Number sections as applicable.

- Input the corporation's address, including the number, street, city, state, and ZIP code.

- Provide the telephone number and state and date of incorporation for the corporation.

- Specify the principal business activity in Kentucky along with the NAICS Code Number.

- Continue by completing Part I—Income Tax fields, especially lines 1 through 10 as they apply to the corporation's income.

- If changes are being made, fill out Part III—Amended Tax Due Computation with accurate figures.

- Provide explanations for any changes in Part IV, referencing the specific lines from previous parts.

- Review the entire form for accuracy before completing the process—options to save changes, download, print, or share the form will be available.

Take control of your filing responsibilities by completing your documents online today.

The 720xxcom Form is required for businesses that must report specific taxes or fees related to certain federal regulations. Generally, those in particular industries such as telecommunications and airlines will find this requirement applicable. With uslegalforms, you can access resources that clarify your obligations and ensure you meet all necessary filing requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.