Loading

Get Jurisdiction15ohiovoluntary Overpayment Refund Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Jurisdiction15ohiovoluntary Overpayment Refund Form online

Filling out the Jurisdiction15ohiovoluntary Overpayment Refund Form online can help streamline your refund process with Medicare. This guide provides clear and step-by-step instructions to ensure successful completion of the form.

Follow the steps to complete the refund form accurately.

- Press the ‘Get Form’ button to access the Jurisdiction15ohiovoluntary Overpayment Refund Form and open it for editing.

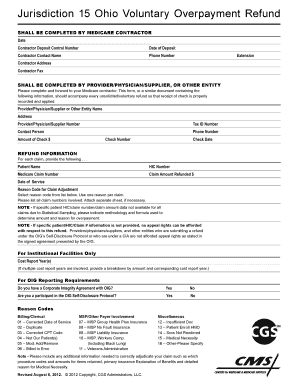

- Enter the date and the contractor deposit control number at the top of the form. These fields are critical for tracking your submission.

- Fill in the contractor's contact name, phone number, extension, address, and fax number. Ensure accuracy for effective communication.

- As the provider or physician, input your name, address, provider number, tax ID number, and contact person information.

- Enter the phone number for the contact person, followed by the amount of the check, the check number, and the check date.

- In the refund information section, provide the patient’s name, HIC number, Medicare claim number, claim amount refunded, and the date of service for each claim.

- Select the reason code for the claim adjustment from the provided list, ensuring that only one reason code is used per claim.

- List all claim numbers involved, and attach a separate sheet if necessary. If specific information is not available, indicate your methodology for determining the amount and reason for overpayment.

- If applicable, provide the cost report year(s) for institutional facilities and indicate whether you have a corporate integrity agreement with the OIG and if you participate in the OIG self-disclosure protocol.

- Review all fields for accuracy. Finally, save your changes, and choose to download, print, or share the completed form as needed.

Complete the Jurisdiction15ohiovoluntary Overpayment Refund Form online today to facilitate your refund process.

A doctor should refund a patient overpayment promptly, typically within 30 days after identifying the overpayment. Using the Jurisdiction15ohiovoluntary Overpayment Refund Form can streamline this process. This form helps clearly communicate the details of the overpayment to the patient. If you’re looking for more information on patient refunds, uslegalforms has valuable resources to guide you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.