Loading

Get Form 13441 A

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 13441 A online

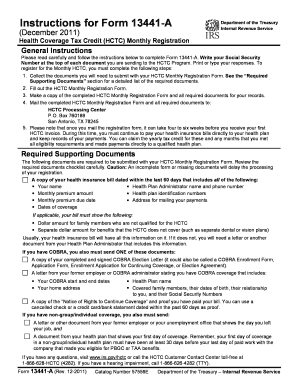

Filling out Form 13441 A online can seem challenging, but with this guide, you will navigate each step with confidence. This comprehensive overview ensures that you provide accurate information to register for the Health Coverage Tax Credit (HCTC) smoothly.

Follow the steps to complete your online registration

- Press the ‘Get Form’ button to access the form and open it in your browser.

- Enter your general information in Part 1, including your name, Social Security number, date of birth, and contact details.

- In Part 2, confirm your eligibility by checking the applicable boxes that describe your situation related to the HCTC.

- Provide information about your qualifying family members in Part 3, ensuring to list any additional family members if necessary.

- Fill out Part 4 with health plan information. Include any necessary coverage details such as the type of coverage and monthly premiums.

- Complete Part 5 if you wish to designate a third-party to access your account information, including selecting a secure PIN.

- Finally, review all the information for accuracy, then sign and date the form in Part 6 to certify that the information is correct.

- Once completed, save your changes. You can download, print, or share the completed form as necessary.

Start filling out your Form 13441 A online today to ensure your eligibility for the Health Coverage Tax Credit.

Yes, the IRS does receive a copy of your 1095-A from the health insurance marketplace. This form is a key part of the tax filing process, as it provides information on your health coverage. Thus, keeping your Form 13441 A and ensuring its accuracy is essential for smoothly navigating your tax obligations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.