Loading

Get Form 9065

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 9065 online

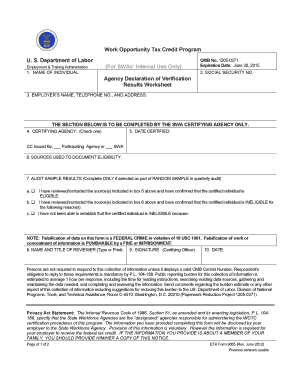

Filling out Form 9065 online is a straightforward process that helps ensure proper documentation for the Work Opportunity Tax Credit program. This guide will walk you through each step of the form to ensure that you provide all the necessary information accurately.

Follow the steps to complete Form 9065 online efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor. This will allow you to access the necessary fields you need to fill out.

- Enter the name of the individual in Box 1. Ensure you provide the full name, including last name, first name, and middle initial.

- In Box 2, enter the individual's Social Security number accurately to identify the person related to the form.

- Complete Box 3 by entering the employer’s name, telephone number, and address with the correct zip code.

- In Box 4, indicate the certifying agency by entering the name of the State Workforce Agency (SWA) that is issuing the certification. Mark the appropriate checkbox indicating if the certification was issued by a Participating Agency or a SWA.

- Enter the date certified in Box 5, using the month, day, and year format.

- For Box 6, document all sources used to verify eligibility. List any documentary evidence or sources of collateral contacts attached to the certification request.

- In Box 7, complete the audit sample results. Use check marks to indicate whether the individual is eligible, ineligible, or if eligibility cannot be determined. If ineligible, provide associated reasons as instructed.

- In Box 8, type or print the name and title of the reviewer who is conducting the audit review.

- Sign in Box 9 using the signature of the certifying officer to confirm the information provided.

- Finally, enter the date again in Box 10, following the month, day, and year format.

- Once you have filled out all relevant sections, you can save changes, download, print, or share the form as required.

Complete your Form 9065 online today to ensure proper documentation and access to tax credits.

The IRS typically takes about 30 to 45 days to process Form 9465, depending on various factors such as their workload and the accuracy of the submitted forms. By utilizing the Form 9065 services from uslegalforms, you can ensure your submission is accurate and possibly speed up processing time.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.