Loading

Get Rpd 41370 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RPD 41370 Form online

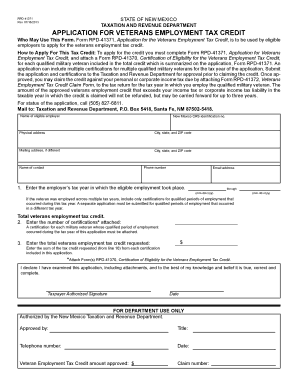

Filling out the RPD 41370 Form online is a straightforward process designed to help eligible employers apply for the Veterans Employment Tax Credit. This guide will walk you through each section of the form, ensuring that all required information is accurately provided.

Follow the steps to complete the RPD 41370 Form online.

- Press the ‘Get Form’ button to obtain the RPD 41370 Form and open it for editing.

- Enter your name as the eligible employer, along with your New Mexico CRS identification number. Provide the physical address of your business, including the city, state, and ZIP code.

- If applicable, enter a different mailing address and related details.

- Input your contact information, including your phone number, name of contact person, and email address.

- Specify the employer's tax year during which the eligible employment occurred, using the required mm-dd-ccyy format.

- Indicate the number of attached certifications (Form RPD-41370) in this application.

- Calculate and enter the total veterans employment tax credit requested, ensuring it adheres to the maximum allowable credit.

- Sign and date the form, confirming that all information provided is accurate and complete.

- After completing the form, save your changes, and prepare to download or print the document for submission.

Complete your documents online today and ensure your application is submitted on time.

Related links form

The working families tax credit in New Mexico is available to low- to moderate-income individuals and families. To qualify, you need to meet specific criteria outlined in the Rpd 41370 Form. This form will help you assess your eligibility and calculate the credit amount accurately. For more detailed eligibility information, consider visiting USLegalForms for tailored advice.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.