Loading

Get Imrf For 7 10

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Imrf For 7 10 online

Navigating the Imrf For 7 10 form can seem challenging, but this guide aims to simplify the process. By following the detailed steps outlined below, users will be able to efficiently complete the form online.

Follow the steps to accurately fill out the Imrf For 7 10 form.

- Click ‘Get Form’ button to obtain the form and open it for completion.

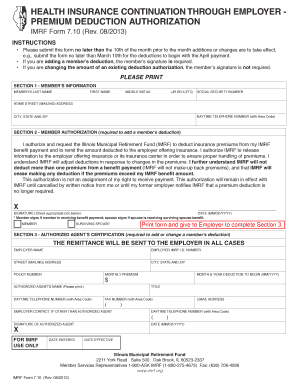

- Begin with Section 1, which requires the member's information. Fill in the member's last name, first name, middle initial, and social security number. Ensure that the information is accurate, as it is crucial for proper identification.

- In Section 1, continue by providing the home street (mailing) address, daytime telephone number with area code, and the city, state, and ZIP code. This information is necessary for IMRF communications.

- If you are adding a deduction for a member, proceed to Section 2. Here, you must check the box indicating your authorization and request for IMRF to deduct insurance premiums from your benefit payments. Sign and date the form where indicated.

- If you are changing the amount of an existing deduction, no signature is required. However, you still need to indicate the changes clearly.

- Once Section 2 is complete, print the form and give it to the employer for Section 3 to be filled out. Section 3 requires the employer to input their information, including employer name, IMRF ID number, and the mailing address.

- In Section 3, the authorized agent must enter details such as their name, daytime telephone number, monthly premium amount, and the start month and year for the deduction.

- Ensure the authorized agent signs and dates the form in the designated area. This certification is necessary for the processing of the deductions.

- After all sections are filled out, review your information for accuracy. Users can then save changes, download, print, or share the form as needed.

Complete your Imrf For 7 10 form online today for a smoother experience.

The 6 percent rule for IMRF outlines how much an employee contributes to their pension, which plays a key role in defining their retirement benefits. This percentage helps accumulate the necessary funds for a secure retirement. Engaging with resources related to Imrf For 7 10 can provide clarity on how these contributions work.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.