Loading

Get Form 14392

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 14392 online

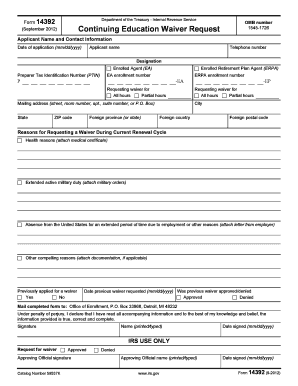

Filling out the Form 14392, also known as the Continuing Education Waiver Request, is an essential process for individuals seeking to waive continuing education requirements. This guide provides clear instructions to assist you in completing the form accurately and efficiently.

Follow the steps to complete the Form 14392 online.

- Click the ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin by entering your applicant name and contact information, including your telephone number and mailing address. Ensure that the information is current and accurate.

- Select your designation from the options provided: Enrolled Agent (EA) or Enrolled Retirement Plan Agent (ERPA). If applicable, include your Preparer Tax Identification Number (PTIN) and EA enrollment number.

- Indicate whether you are requesting a waiver for all hours or partial hours in the appropriate section.

- Provide detailed reasons for requesting the waiver during the current renewal cycle. Choose from the options: health reasons, extended active military duty, prolonged absence from the United States, or other compelling reasons. Attach relevant documentation for your claims.

- If applicable, indicate whether you have previously applied for a waiver and provide the date of the previous request. Specify if the previous waiver was approved or denied.

- Review all entered information for accuracy and completeness. To finalize, include your signature and printed name along with the date signed.

- Once the form is completely filled out, you can save your changes. Depending on your needs, download, print, or share the document as required.

Complete your Form 14392 online today to submit your waiver request promptly.

Filing Form 8940 requires you to complete the application for Miscellaneous Income. First, make sure you have all necessary financial information and supporting documents. It is important to follow the IRS instructions closely to ensure accuracy. If you are uncertain about how this form ties into your tax situation, utilizing Form 14392 can help clarify your obligations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.