Loading

Get Connecticut E911 Remitance Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Connecticut E911 Remittance Form online

Filling out the Connecticut E911 Remittance Form online is a straightforward process that ensures effective communication of essential surcharge information. This guide will provide you with step-by-step instructions to navigate each section of the form accurately and efficiently.

Follow the steps to complete the Connecticut E911 Remittance Form online.

- Press the ‘Get Form’ button to access the Connecticut E911 Remittance Form and open it in your preferred document editor.

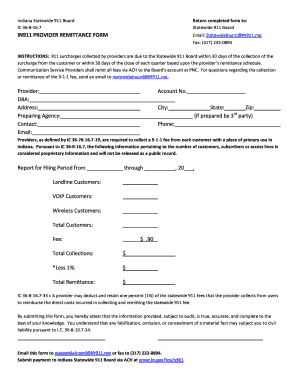

- Begin by entering your provider information. Fill in the 'Provider' section with your business name and the 'DBA' (doing business as) name if applicable. Make sure to accurately include your address, city, state, and zip code.

- In the 'Preparing Agency' field, indicate the agency responsible for completing the form. Include contact details such as the contact person’s name and email address to facilitate communication.

- Input your account number to help the relevant authorities link your submission to your specific account.

- Fill in the 'Report for Filing Period from' section to indicate the start and end dates of the applicable filing period.

- Provide the number of customers in each category—landline, VOIP, and wireless. Ensure that the totals are accurate to avoid discrepancies.

- Calculate the fees based on the number of customers and input the total collections. Deduct 1% from the total collections as allowed to reimburse direct costs incurred in collecting and remitting the fee.

- Finally, ensure you affirm the accuracy of the information by checking the attestation box on the form. Review your form for any errors or omissions before submission.

- Once completed, save your changes, and utilize the options to download or print the form as needed. You can then share the document through your preferred method of submission.

Complete your Connecticut E911 Remittance Form online today for accurate processing and compliance.

When making a payment for CT state taxes, you should make your check payable to the 'Connecticut Department of Revenue Services.' This applies to payments for forms including the Connecticut E911 Remittance Form, ensuring your payment is directed to the correct agency.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.