Get Form 8951

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8951 online

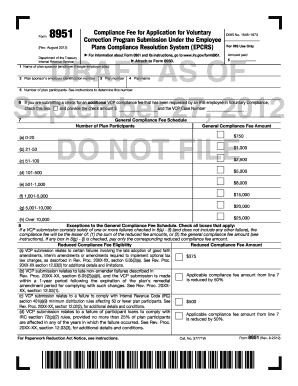

Form 8951 is essential for determining and submitting the compliance fee associated with an application for voluntary correction under the Employee Plans Compliance Resolution System. This guide outlines a clear, step-by-step process to assist you in filling out the form online, ensuring a smooth submission.

Follow the steps to complete Form 8951 accurately.

- Click the ‘Get Form’ button to access the form and open it in your preferred online editor.

- In the first section, enter the name of the plan sponsor (the employer if it is a single-employer plan) in line 1.

- For line 2, input the plan sponsor’s employer identification number.

- In line 3, provide the plan number associated with your plan.

- Complete line 4 by entering the name of the plan you are submitting for compliance.

- On line 5, indicate the number of plan participants based on the information from the most recently filed Form 5500.

- If applicable, check the box on line 6 if you are submitting a check for an additional VCP compliance fee as requested by an IRS employee.

- Refer to the General Compliance Fee Schedule in line 7 and select the fee amount based on the number of plan participants.

- In line 8, indicate any exceptions that apply by checking the appropriate boxes for reduced compliance fee eligibility.

- Review all entries for accuracy before saving your progress.

- Once completed, you can save the changes, download, print, or share the form as needed.

Don't wait—complete and submit Form 8951 online to ensure compliance for your plan.

To process Form 8821, start by filling out the form with accurate details pertaining to the taxpayer and the representative. Submit it directly to the IRS and keep copies for your records. If you use a platform like UsLegalForms, you can get additional guidance, templates, and compliance tips that streamline the process. Form 8951 might be helpful in your overall tax compliance strategy, making sure you address any potential issues ahead of time.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.