Loading

Get 43 1 2715888 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 43 1 2715888 Form online

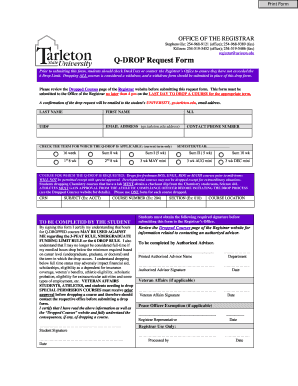

Filling out the 43 1 2715888 Form online is a crucial step for users looking to manage their academic course loads effectively. This guide provides a clear and structured approach to completing the form accurately and efficiently.

Follow the steps to complete the 43 1 2715888 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your last name in the appropriate field.

- Input your first name and middle initial (if applicable).

- Provide your University Identification Number (UID#) in the designated area.

- Fill in your email address, ensuring you use your go.tarleton.edu address.

- Enter your contact phone number, ensuring it is accurate.

- Select the term for which the Q-Drop is applicable by checking the appropriate box.

- Specify the semester and year of the current term.

- Identify the course for which you are requesting the Q-Drop by entering the Course Reference Number (CRN), subject, course number, section, and location.

- Obtain the required signature from an authorized advisor before submitting the form to the Registrar's Office.

- Review all entered information for accuracy before submission.

- After completing the form, you can save changes, download, print, or share the form as needed.

Start completing your documents online for more efficient management.

If you disagree with a 143(1)(a) notice, you have the right to appeal. Gather supporting documents and evidence that clarify your position, especially related to the 43 1 2715888 Form. You can submit your disagreement in writing to the IRS, explaining your case clearly. Consulting with a tax professional or using uslegalforms can provide additional support in navigating this process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.