Get Fdiv3601 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fdiv3601 Form online

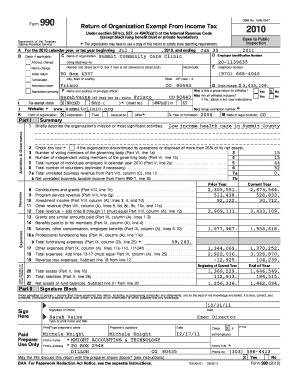

Completing the Fdiv3601 Form online is a straightforward process designed to help users efficiently report information regarding their organization’s finances. This guide will walk you through each section of the form, ensuring that you understand the requirements and necessary details.

Follow the steps to accurately complete the Fdiv3601 Form.

- Click the ‘Get Form’ button to obtain the Fdiv3601 Form and open it in your editor.

- Enter the organization’s name as it appears in official documents. Ensure you provide accurate and complete information.

- Fill in the Employer Identification Number (EIN) to uniquely identify your organization. This number is crucial for processing and verification.

- Indicate whether this is an amended return or an initial filing by checking the appropriate box. Select correctly to prevent processing delays.

- Report the financial data for the current tax year, including gross receipts, total revenue, and specific expenses. Accuracy is important to reflect the organization’s financial status.

- Review each section for the required information about contributions, grants, and membership dues received. Attach any necessary documentation to support these entries.

- Complete the sections related to expenses, ensuring you capture all operational costs incurred during the period covered by the form.

- If applicable, disclose any loans to or from interested persons as per the guidelines set forth. Carefully read the instructions to avoid omissions.

- Double-check all entries for correctness before finalizing the form. Errors can lead to complications in processing.

- Once complete, save your entries. You can then download, print, or share the form as needed. Ensure you retain a copy for your records.

Start filling out the Fdiv3601 Form online today to ensure your organization’s compliance and financial reporting.

For beginners, the first step is to collect all financial documents related to income and expenses. Utilize the Fdiv3601 Form to organize this information systematically and accurately. Platforms like uslegalforms provide templates and guidance that can be incredibly helpful. Following these steps will ensure that you complete your tax return with confidence.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.