Get 1099 Certification Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1099 Certification Form online

Completing the 1099 Certification Form online is essential for sellers of a principal residence who want to determine reporting requirements. This guide will provide clear, step-by-step instructions to help you navigate the process smoothly.

Follow the steps to complete the form with ease.

- Click ‘Get Form’ button to retrieve the 1099 Certification Form and open it in your preferred online editor.

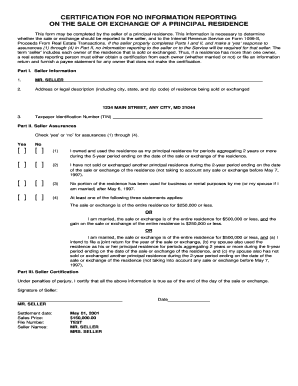

- In Part I, enter the seller's information. Provide the full name of the seller, the address or legal description of the residence including city, state, and zip code, and the Taxpayer Identification Number (TIN). Ensure that all information is accurate.

- Move on to Part II, where you will find seller assurances. For each of the four assurances, check either 'yes' or 'no' based on your situation. Carefully read each statement to ensure you are making an informed decision.

- In Part III, sign the form to certify that all provided information is true. Include the date of the signature, settlement date, sales price, file number, and the names of all sellers.

- Once you have completed the form, review all entries for accuracy. After confirming that everything is correct, you can save your changes, download a copy for your records, print the form, or share it as needed.

Complete your documents online today to ensure a smooth filing process.

A 1099 employee needs to fill out their personal information, including their name, address, and taxpayer identification number, on the 1099 Certification Form. They must accurately report the amounts they received on this form to ensure that the information matches the payers' records. It is also important for them to keep a copy for their tax records. If they require more help, uslegalforms can guide them through the process and ensure compliance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.