Get Bexar Appraisal District Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bexar Appraisal District Forms online

Filling out the Bexar Appraisal District Forms online can streamline the process of applying for property tax exemptions. This guide provides clear instructions to help users navigate each section of the form effectively and efficiently.

Follow the steps to complete the Bexar Appraisal District Forms with ease.

- Click 'Get Form' button to access the Bexar Appraisal District Forms and open it in your preferred editor.

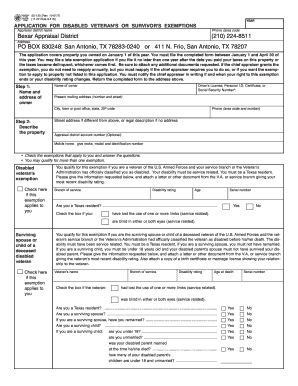

- In the first section, enter the name and address of the property owner. This includes providing the owner's name, Driver's License, Personal I.D. Certificate, or Social Security Number, and the current mailing address. Ensure accuracy to avoid processing delays.

- Describe the property by entering the street address or legal description if the address is not available. Include the appraisal district account number, if you have it, and provide details about the mobile home if applicable.

- Check the exemptions that apply to you. You may qualify for multiple exemptions based on your status as a disabled veteran, surviving spouse, or child of a disabled veteran. Fill in the respective fields with required information, including disability rating and residency status.

- If applicable, indicate whether you are submitting a late application for a previous tax year. Make sure to provide the prior tax year if you meet the qualifications.

- At the end of the form, sign to certify that all information provided is accurate. Ensure the date of signature is included, as this is vital for the processing of your application.

- After completing the form, save changes, and choose to download, print, or share the document as needed for your submissions.

Take the next step and complete your Bexar Appraisal District Forms online today.

To check your appraisal in Bexar County, visit the Bexar Appraisal District's website, where you can easily search for your property. The site provides straightforward access to your records and Bexar Appraisal District Forms necessary for reviewing your information. You can also utilize online tools to track any changes or updates related to your appraisal value. This process ensures you stay informed about your property's status.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.