Loading

Get Small Business (schedule C) Client Organizer

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Small Business (schedule C) Client Organizer online

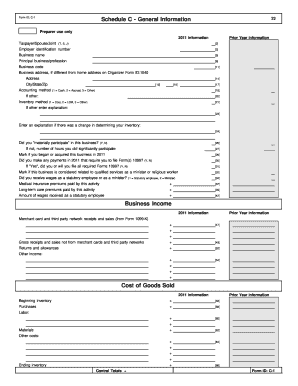

Filling out the Small Business (schedule C) Client Organizer online is an important step for business owners to report their income and expenses accurately. This guide will walk you through the necessary steps to complete the form, ensuring that you have all the information you need at hand.

Follow the steps to complete your Small Business (schedule C) Client Organizer online.

- Press the ‘Get Form’ button to access the Small Business (schedule C) Client Organizer and open it in your preferred editor.

- Begin by entering your employer identification number in the designated field. This helps to identify your business for tax purposes.

- Fill in your business name as it is officially registered, ensuring accuracy for proper identification.

- Describe your principal business or profession in the appropriate section. This provides clarity about your business activities.

- Reference the business code that corresponds to your type of business. This can usually be found in the IRS guidelines.

- If your business address differs from your home address, complete the business address section, including street, city, state, and zip code.

- Select your accounting method from the options provided: cash, accrual, or another method. Indicate this in the relevant field.

- If applicable, specify your inventory method as cost, lower of cost or market, or another method, and provide any necessary explanations.

- Answer the question regarding material participation in your business by indicating 'Yes' or 'No' and providing hours if needed.

- Mark if you purchased or acquired the business in the tax year mentioned, which can affect your tax reporting.

- Indicate any payments made in the tax year that require filing Form 1099 and note if all necessary forms have been or will be filed.

- Complete the income section, detailing your gross receipts and sales as well as any other income sources.

- Fill out the cost of goods sold area, documenting beginning inventory, purchases, labor costs, and any other relevant expenses.

- As you move to the expenses section, input all applicable business expenses including advertising, vehicle expenses, legal services, and other costs.

- After completing all sections, ensure that you save your changes, download the form, or print it for your records.

Start filling out your Small Business (schedule C) Client Organizer online today!

A tax organizer helps you collect, organize, and manage your financial information for tax purposes. It streamlines your tax preparation process, ensuring that you have all necessary documentation at your fingertips. With a small business (Schedule C) client organizer, you can see the big picture of your finances, making your tax filing smoother and more efficient.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.