Get Tax Preparation - Client Information Sheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Preparation - Client Information Sheet online

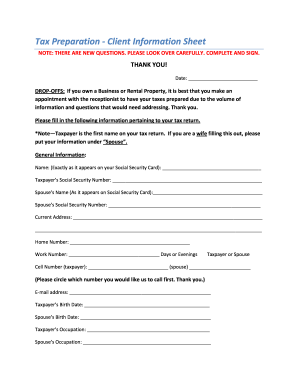

Completing the Tax Preparation - Client Information Sheet online is an important step in ensuring your tax return is accurate and complete. This guide provides clear instructions to help you fill out each section of the form efficiently.

Follow the steps to complete your Tax Preparation - Client Information Sheet online.

- Press the ‘Get Form’ button to access the Tax Preparation - Client Information Sheet and open it in your preferred digital editor.

- Begin with the general information section. Enter your name exactly as it appears on your Social Security Card. Include your Social Security number and your spouse's details if applicable.

- Fill in your current address, home and work phone numbers, and email address. Specify if you prefer a particular number to be contacted.

- Provide your and your spouse's birth dates and occupations in the designated fields.

- If you are a New York resident, answer the questions regarding renter’s credit and child support eligibility. Provide your monthly rent amount and any utilities included.

- Select your filing status from the options provided. Make sure to indicate if anyone else can claim you as a dependent.

- In the dependent information section, list the required details for each dependent, including their names, Social Security numbers, birth dates, and living situation.

- If applicable, summarize any childcare expenses, providing the daycare's name and address, the amount paid, and the child’s details.

- Document any student loan interest paid by you or your spouse in the respective sections, along with tuition expenses if relevant.

- Decide how you want to file your tax return: e-file, RAC, use a Western Union debit card, or opt for a paper return. Complete the necessary details for your chosen method.

- Indicate whether you would like Audit Shield Protection and answer any additional questions about your financial situation.

- Finally, review all entered information for accuracy and completeness. After confirming the details, you can save your changes, download, print, or share the completed form.

Start filling out your Tax Preparation - Client Information Sheet online today to ensure a smooth tax filing process.

Finding tax prep clients can be achieved through a variety of effective strategies. Networking within your community, utilizing social media, and offering educational workshops can attract potential clients. Additionally, showcasing the value of your services through well-crafted materials, including a shopper-friendly Tax Preparation - Client Information Sheet, will make you more appealing to potential customers.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.