Loading

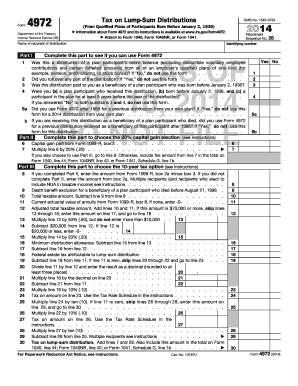

Get Enter The Amount From Form 1099-r, Box 2a Minus Box 3 - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Enter The Amount From Form 1099-R, Box 2a Minus Box 3 - IRS online

Filling out the Enter The Amount From Form 1099-R, Box 2a Minus Box 3 is an important step for tax reporting regarding distributions from retirement plans. This guide will provide clear, step-by-step instructions to ensure you complete this section accurately online.

Follow the steps to effectively fill out your Form 1099-R information.

- Press the 'Get Form' button to access the document and open it in your online editor.

- Review the identification fields at the top of the form. Ensure to fill in your name and identifying number accurately.

- Locate Box 2a and Box 3 on your Form 1099-R. Box 2a represents the taxable amount, while Box 3 indicates any capital gain amount.

- Subtract the amount in Box 3 from the amount in Box 2a. This result is what you will enter as your taxable amount from the distribution.

- Check if other entries are required, such as federal estate tax or any allowable exclusions for death benefits, and complete those sections accordingly.

- Once all necessary fields are filled out, proceed to save your changes, and then download, print, or share the completed form as needed.

Start filling out your tax documents online today!

Related links form

Box 2a may be left blank for Traditional IRA withdrawals because the financial institution may lack the necessary information to determine the taxable portion accurately. This can happen if you made non-deductible contributions to your IRA. For clarity, it’s beneficial to review your contributions and consult tax resources. Always enter the amount from Form 1099-R, Box 2a minus Box 3 - IRS to complete your tax return accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.