Loading

Get Fill In Form Ar 1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fill In Form Ar 1 online

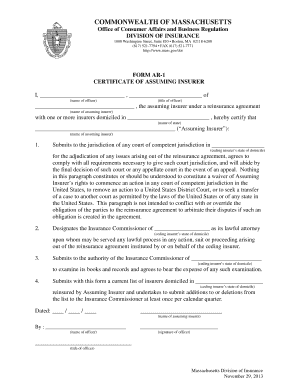

Filling out the Fill In Form Ar 1 is an important process for assuming insurers working under reinsurance agreements. This guide provides clear, step-by-step instructions to help users navigate each section of the form with confidence.

Follow the steps to complete the Fill In Form Ar 1 accurately.

- Press the ‘Get Form’ button to access the Fill In Form Ar 1 and open it in your preferred online editor.

- Begin by entering the name of the officer who is certifying the form in the first blank line provided. This should reflect the full name of the person responsible.

- In the next field, input the title of the officer (e.g., Chief Executive Officer, President) as it relates to their position within the assuming insurer.

- Next, specify the name of the assuming insurer in the designated blank space, ensuring accuracy to avoid issues later in the process.

- Identify the state where the reinsurance agreement is based by filling in the relevant name of the state in the next blank.

- In this section, affirm the submission to jurisdiction by providing the name of the ceding insurer's state of domicile.

- Designate the Insurance Commissioner by stating the name of the ceding insurer's state of domicile where applicable.

- Input the state for which the Insurance Commissioner will perform examinations of books and records in the appropriate field.

- Attach a current list of insurers that are domiciled in the same state being referenced. This list should be submitted along with the form and periodically updated as necessary.

- Finally, input the date the form is being completed, followed by the name, signature, and title of the officer who certifies the document.

- Once all fields are accurately filled, you can save your changes, download the document, print it, or share it as necessary.

Complete the Fill In Form Ar 1 online to streamline your insurance processes today.

Yes, part-time employees are required to file taxes if their income exceeds certain thresholds set by the IRS and state laws. Even if you work part-time, you may still owe taxes, and filing ensures you comply with legal obligations. Using resources like the Fill In Form AR 1 on US Legal Forms can make this task much simpler. It provides you with the tools to complete your tax forms accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.