Get Artrs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Artrs online

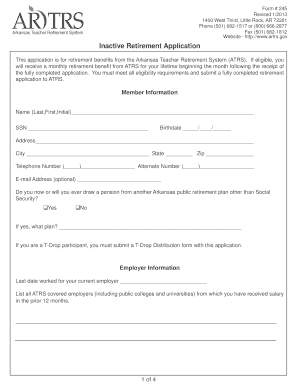

Filling out the Artrs form online is a straightforward process that ensures you apply for retirement benefits from the Arkansas Teacher Retirement System effectively. This guide will outline each section of the form and provide step-by-step instructions to assist users in completing the application accurately and efficiently.

Follow the steps to complete your Artrs application online:

- Press the ‘Get Form’ button to acquire the Artrs application and open it in the editor.

- Begin by entering your member information. Fill in your name in the format Last, First, Initial, followed by your Social Security Number and birthdate.

- Provide your address details, including city, state, and zip code. Include your telephone and alternate numbers, as well as your email address, if applicable.

- Indicate whether you currently receive or will ever draw a pension from another Arkansas public retirement plan, selecting 'Yes' or 'No' as appropriate.

- If applicable, provide details regarding your employer information, including the last date you worked and list all ATRS covered employers from whom you received salary in the previous 12 months.

- Select your retirement annuity option by checking only one box. Options include Option 1, Option A-100% Survivor Annuity, Option B-50% Survivor Annuity, and Option C-10 Year Certain Annuity. Fill in the necessary beneficiary information for the selected option.

- Read and acknowledge the termination requirements clearly stated in the form. Confirm your understanding and agreement by signing and dating the section.

- Review your completed application for accuracy. You can save changes, download, print, or share the form as necessary.

Take action now and complete your Artrs application online to ensure your retirement benefits are processed efficiently.

Yes, ATRS is a pension plan designed specifically for Arkansas teachers. As a defined benefit plan, ATRS guarantees a specific monthly benefit upon retirement, based on your service and salary history. This means educators enjoy a stable income, helping them plan their lives post-retirement with confidence. Employing ATRS as part of your retirement strategy ensures you have a solid financial foundation to build your future.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.