Get Ar1075 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AR1075 form online

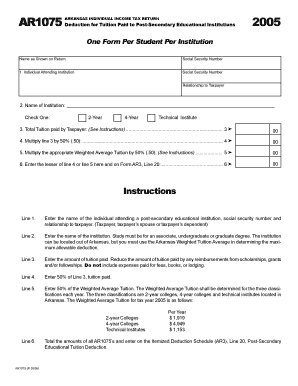

The AR1075 form is essential for individuals looking to deduct tuition paid to post-secondary educational institutions on their Arkansas individual income tax return. This guide will provide a step-by-step approach to successfully complete the form online, ensuring that you maximize your eligible deductions.

Follow the steps to fill out the AR1075 form correctly.

- Click 'Get Form' button to access the AR1075 form and open it in your online editor.

- Begin by entering the name of the individual attending the institution along with their social security number and relationship to the taxpayer, which may be the taxpayer themselves, their spouse, or a dependent.

- Next, input the name of the educational institution. Specify whether it is a 2-year or 4-year college, or a technical institute. Note that institutions located outside of Arkansas are also acceptable, but you will need to use the Arkansas Weighted Tuition Average for deductions.

- In this section, you will enter the total amount of tuition paid by the taxpayer. Be sure to reduce this amount by any scholarships, grants, or fellowships received, and exclude any fees, books, or lodging expenses from this figure.

- Now, calculate 50% of the tuition amount you just entered in step 4 and enter this value on the corresponding line.

- Determine 50% of the Weighted Average Tuition applicable to the institution type mentioned in step 3. Use the established averages for 2-year colleges, 4-year colleges, or technical institutes to find this value.

- Finally, compare the results from step 5 and step 6. Enter the lesser amount on line 6 of the form. This value will also need to be reported on Form AR3, Line 20 for itemized deductions.

- Once all entries are complete and verified, save your changes, and you may choose to download, print, or share the filled AR1075 form as needed.

Begin filling out your AR1075 form online today to take advantage of your eligible tuition deductions.

In Arkansas, seniors often see a reduction in property taxes when they reach the age of 65. However, to fully benefit, they must meet specific requirements and file appropriate forms, like the AR1075 Form. Tax exemptions for seniors can significantly ease financial burdens, so it's worth looking into the qualifications for these benefits.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.