Loading

Get Tutoring Income On Massachusetts Tax Return Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tutoring Income On Massachusetts Tax Return Form online

Filing your tutoring income accurately on your Massachusetts tax return is essential for compliance and ensuring you receive any eligible deductions. This guide provides clear, step-by-step instructions on how to complete the Tutoring Income On Massachusetts Tax Return Form online.

Follow the steps to accurately complete your tax return form.

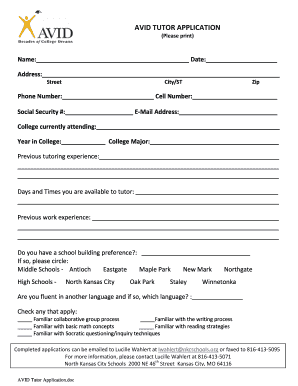

- Click ‘Get Form’ button to access the Tutoring Income On Massachusetts Tax Return Form and open it in the editor.

- Begin filling in your name at the top of the form. Ensure to provide your full legal name as it appears on your identification documents.

- Next, enter your current address, including street, city, state, and zip code. Accurate address information is vital for proper tax processing.

- Provide your phone number and cell number. This ensures the tax authority can reach you if necessary.

- Input your Social Security number in the designated field. This number is crucial for tax identification purposes.

- Enter your email address for electronic communication regarding your tax return.

- Specify your college currently attending and your year in college. This information is relevant if you are a student tutor.

- Describe your college major, as it may impact your eligibility for specific tax benefits.

- Detail your previous tutoring experience, including the subjects taught and duration of experience.

- Indicate your availability for tutoring, listing specific days and times you can offer services.

- Provide information about any previous work experience, especially if it relates to education or tutoring.

- If you have a preference for a school building, specify that and select from the listed options.

- Note any languages you are fluent in, as this can enhance your tutoring profile.

- Check any skills that apply to you from the provided list, as these may be relevant to your tutoring income and capabilities.

- Finally, review all the information you've entered for accuracy and completeness. Make any necessary corrections before proceeding.

- Once you have completed the form, you can save changes, download a copy, or print it for your records.

Complete your Tutoring Income On Massachusetts Tax Return Form online today for an efficient tax filing experience.

Related links form

Many educational expenses can be tax deductible, including tuition, books, and necessary supplies related to tutoring. When completing your Tutoring Income On Massachusetts Tax Return Form, make sure to identify which expenses qualify. Proper documentation of these costs can lead to substantial tax benefits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.