Get Wall Certificate/pocket Id Replacement Request Form - Dca Ca

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wall Certificate/Pocket ID Replacement Request Form - Dca Ca online

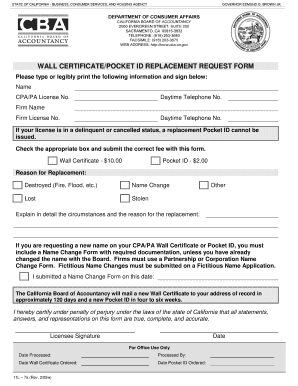

Filling out the Wall Certificate/Pocket ID Replacement Request Form is a straightforward process that requires careful attention to detail. This guide will provide you with step-by-step instructions to complete the form accurately and efficiently online.

Follow the steps to successfully complete the replacement request form.

- Click 'Get Form' button to obtain the form and open it in the editor. This action will allow you to access the necessary document for your replacement request.

- Begin by filling in your personal information in the provided fields. Enter your full name, CPA/PA license number, and your daytime telephone number. Make sure this information is accurate for proper identification.

- Next, provide your firm's name and license number, along with the daytime telephone number for the firm if applicable.

- Indicate the status of your license. If your license is delinquent or canceled, note that a replacement Pocket ID cannot be issued.

- Select the appropriate box indicating the reason for your replacement request, such as 'Lost,' 'Stolen,' or 'Name Change.' If you choose 'Other,' provide a detailed explanation of the circumstances.

- If applicable, attach any necessary documentation related to a name change and include a submitted Name Change Form date.

- Review the certification statement at the bottom of the form. This statement confirms that all information provided is true and accurate. Sign and date the form in the designated areas.

- Once the form is completed, save your changes, and make sure to download or print a copy for your records.

- Finally, submit the form along with the appropriate fee to the California Board of Accountancy at the specified mailing address.

Complete your Wall Certificate/Pocket ID Replacement Request Form online today to ensure your credentials are up to date.

To qualify for a CPA license in California, you must complete at least 12 months of qualifying work experience. This experience should occur under the supervision of a licensed CPA, ensuring you gain real-world skills and knowledge. Both public and private accounting experiences may be accepted, preparing you for diverse career opportunities. If you have questions about the verification process, the Wall Certificate/Pocket ID Replacement Request Form - Dca Ca can assist you in navigating your requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.