Loading

Get Henry Strong Loan Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Henry Strong Loan Form online

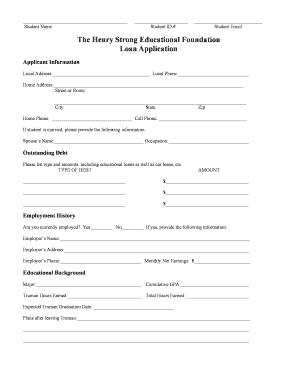

The Henry Strong Loan Form is an essential document for students seeking financial assistance to further their education. This guide provides clear and supportive steps to help users complete the form online effectively.

Follow the steps to fill out the Henry Strong Loan Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your applicant information, which includes your local and home address, phone numbers, and email. This information is crucial for communication purposes.

- If applicable, provide information about your spouse, including their name and occupation.

- List any outstanding debts you may have. Be sure to include both educational and personal loans, stating the type and the amounts clearly.

- Indicate your employment status. If you are currently employed, provide your employer's name, address, phone number, and your monthly net earnings.

- Complete your educational background by filling in your major, cumulative GPA, total hours earned, and expected graduation date, along with your plans after leaving the university.

- In the references section, provide contact information for your parents and two additional personal references. Ensure to include their names, relation to you, occupations, and addresses.

- Specify the requested loan amount, keeping in mind the eligibility criteria and loan limits.

- Review all information for accuracy. Confirm that the information provided is true to the best of your knowledge and proceed to provide your signature and date.

- Finally, save changes, then download, print, or share the completed form as required. Submit it to the Financial Aid Office as instructed.

Complete your application for the Henry Strong Loan online now!

The limit on student loan borrowing depends on various factors, including the type of loan and the student's year in school. For federal loans, undergraduate students can typically borrow between $5,500 and $12,500 annually. For graduate students, the limit can reach up to $20,500 per year. Using the Henry Strong Loan Form can help you understand your specific borrowing capabilities and streamline your loan process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.