Loading

Get T2033

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the T2033 online

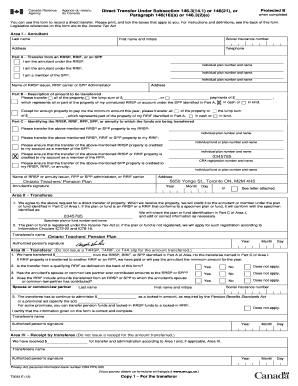

The T2033 form is essential for recording a direct transfer of funds between various retirement accounts. This guide will provide a clear, step-by-step approach to successfully completing the T2033 online.

Follow the steps to fill out the T2033 form online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- In Area I, enter the personal details of the annuitant, including last name, first name and initials, social insurance number, telephone, and address.

- Complete Part A, indicating whether you are the annuitant under the RRSP, RRIF, or SPP while providing the relevant individual plan numbers and names.

- In Part B, describe the amount to be transferred, specifying either the lump sum, all of the property, or payments representing part of the property of your unmatured RRSP or account under the SPP.

- In Part C, identify the RRSP, RRIF, RPP, SPP, or annuity to which the funds are being transferred, providing required names, individual plan numbers, and addresses.

- Ensure that the annuitant signs Area I. If a different party completes this area, attach a signed letter requesting the transfer.

- In Areas II and III, complete each section as required by the transferee and transferor, ensuring that all necessary signatures and details are provided.

- Once all areas are complete, review the form for accuracy before finalizing it.

- Save your changes, download, print, or share the form as necessary.

Complete your T2033 form online for efficient retirement fund transfers.

Related links form

T2033 is a Canadian tax form used for transferring Registered Retirement Savings Plan (RRSP) funds to a US retirement account. This form simplifies the process of managing your retirement assets if you’re moving to the US, as it allows you to transfer funds without immediate tax consequences. Utilizing T2033 is crucial for preserving your retirement savings during international relocations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.