Loading

Get It Rhc2009 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the It Rhc2009 Form online

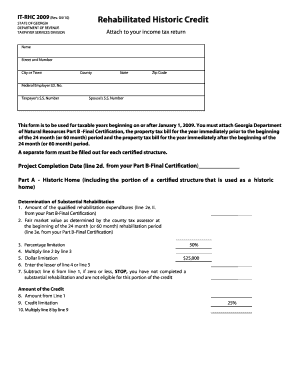

The It Rhc2009 Form is a crucial document for individuals seeking the rehabilitated historic credit in Georgia. This guide will walk you through each section and field of the form, helping you complete it accurately and efficiently online.

Follow the steps to complete the It Rhc2009 Form online.

- Press the 'Get Form' button to access the document and open it in your preferred editor.

- Locate the section for personal information, and fill in your name, street address, city or town, county, state, zip code, federal employer identification number, your Social Security number, and your spouse's Social Security number, if applicable.

- Identify the relevant part for your rehabilitation project: Part A for historic homes, Part B for historic homes located in a target area, or Part C for any other structure. Fill in the necessary expenditures and values for each selected part.

- For Part A, provide the total rehabilitation expenditures and fair market value. Follow the formulas outlined in the section to calculate the credit amount. Make sure to check if you qualify for substantial rehabilitation.

- In Part B, similarly enter the required information and carry out any mathematical computations to determine your eligible credit.

- For Part C, complete the lines with appropriate figures and perform calculations to understand the credit limitations.

- After completing all relevant sections, review your entries for accuracy. Once verified, you can proceed to save your changes, download, print, or share the completed form.

Ensure you complete your forms online for maximum efficiency and convenience.

Related links form

To fill out a form for a stimulus check, first check if you qualify based on your income and filing status. On the It Rhc2009 Form, provide your relevant personal information and bank details for direct deposit. Be sure to follow the guidelines carefully to avoid any processing delays. For more comprehensive assistance, US Legal Forms can help simplify the process and ensure that you submit all required information correctly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.