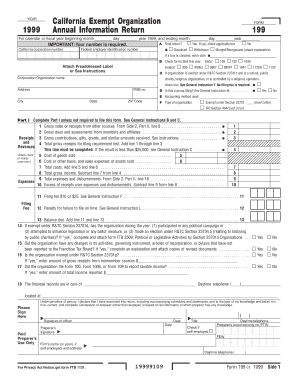

Get 1999 Form 199

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1999 Form 199 online

This guide provides clear, step-by-step instructions for completing the California Exempt Organization Annual Information Return, Form 199, online. Whether you are a seasoned filer or a first-time user, this comprehensive approach will help ensure you meet all requirements accurately and efficiently.

Follow the steps to fill out Form 199 with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the calendar or fiscal year dates at the beginning of the form. Specify the beginning month, day, and year of 1999, along with the ending month, day, and year. This information is crucial for establishing the reporting period.

- Indicate if this is a final return by checking the appropriate box. If the organization has been dissolved, withdrawn, or merged/reorganized, provide the corresponding details.

- Fill in the California corporation number and federal employer identification number. These identifiers are essential for processing your return.

Complete your Form 199 online today to ensure compliance and streamline your organization’s filing process.

To access old 1099 forms, check your past tax documents, as they are typically sent out annually. Additionally, contact your employer or financial institution, as they might have your records archived. If you are specifically looking for the 1999 Form 199, be specific when you request this older documentation to assist the issuer in finding it.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.