Get Florida Department Of Revenue Application For Sales And Use Tax Exemption For Gold Seal Quality Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Florida Department Of Revenue Application For Sales And Use Tax Exemption For Gold Seal Quality Form online

Completing the Florida Department Of Revenue Application For Sales And Use Tax Exemption For Gold Seal Quality Form online is a straightforward process. This guide provides clear, step-by-step instructions to help users efficiently fill out the form and ensure the necessary information is accurately submitted.

Follow the steps to successfully complete your application.

- Click ‘Get Form’ button to retrieve the application and open it for editing.

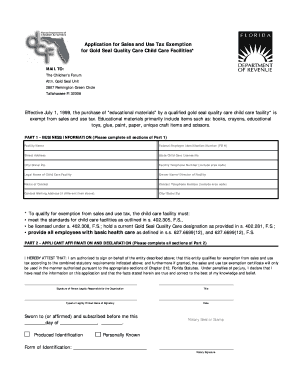

- In Part 1, provide your facility information. Input the facility name, Federal Employer Identification Number (FEIN), street address, state child care license number, and city/state/zip code. Ensure that the facility telephone number and the legal name of the child care facility are also included, along with the owner name/director of the facility, contact person's name, their telephone number, and mailing address, if different.

- To qualify for the exemption, make sure to review the eligibility criteria. The child care facility must meet specific standards, hold a current Gold Seal Quality designation, and provide employees with basic health care as described in the relevant Florida statutes.

- In Part 2, confirm your authorization to sign on behalf of the organization. Attest that the entity qualifies for the exemption by checking all applicable statements. Your printed name and signature as the person legally responsible for the organization must be included.

- Have your signature notarized. Fill in the date, title, and ensure your identification is produced. The notary public must complete their section, including their signature and seal.

- Once all sections are filled out completely, review the form for accuracy. Save all changes, and proceed to download or print a copy of the completed application for your records.

Complete your Florida Department Of Revenue Application For Sales And Use Tax Exemption For Gold Seal Quality Form online today!

In Florida, certain gold, silver, and platinum bullion may qualify for tax exemption under specific conditions. When considering sales tax exemptions for bullion, taxpayers often utilize the Florida Department Of Revenue Application For Sales And Use Tax Exemption For Gold Seal Quality Form to establish eligibility. However, it is essential to verify the current regulations and ensure compliance with applicable laws to take advantage of these exemptions.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.