Loading

Get Cal Sters Hardship Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cal Sters Hardship Form online

The Cal Sters Hardship Form is a vital document for individuals facing immediate financial needs. This guide provides comprehensive, step-by-step instructions for completing the form online to ensure you accurately submit your request for a hardship withdrawal.

Follow the steps to successfully complete the hardship application.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred editing tool.

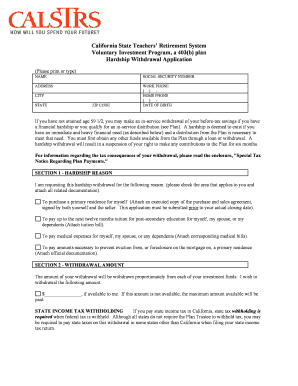

- Begin by filling in your personal information in the designated fields: enter your full name, social security number, and current address. Ensure that each entry is accurate to prevent any delays in processing.

- Provide your contact information by entering your work phone, home phone, and date of birth. This helps in verifying your identity and contacting you if necessary.

- In Section 1, select the reason for your hardship withdrawal by checking the appropriate box. This could include purchasing a primary residence, paying for tuition, covering medical expenses, or preventing eviction/foreclosure. Remember to attach the required documentation relevant to your chosen reason.

- In Section 2, specify the amount you wish to withdraw. Indicate whether the requested amount is available to you. If not, be aware that the maximum available amount will be disbursed.

- Review the state income tax withholding guidance provided in Section 2 to understand your potential tax obligations. This is crucial for planning your finances post-withdrawal.

- Complete Section 3 by signing and dating the certification statement. Your signature confirms that all information provided is accurate and acknowledges your understanding of the tax notice.

- If you have a spouse, ensure they complete Section 4 by providing their signature and date. Their consent is necessary for the processing of your request.

- Finally, ensure that your employer's signature is obtained at the bottom of the form. This approval is required for submission.

- Once all sections are completed and reviewed, save any changes made to the form. You can download, print, or share the completed document as needed.

Complete your Cal Sters Hardship Form online today to address your financial needs.

Related links form

Yes, it is possible to do a hardship withdrawal from the Teacher Retirement System (TRS). However, the specifics can vary based on your unique situation and plan rules. To better understand your options, consider using the Cal Stirs Hardship Form for guidance and to navigate the requirements effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.