Get Dreyfus Inherited Ira Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dreyfus Inherited IRA form online

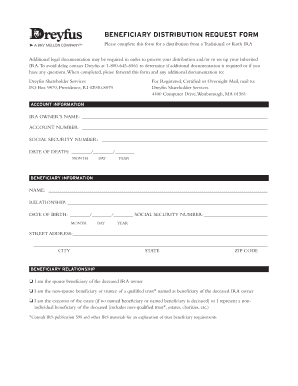

Filling out the Dreyfus Inherited IRA form online can simplify the process of requesting a distribution from a Traditional or Roth IRA. This guide will walk you through each section of the form to ensure a smooth and efficient completion.

Follow the steps to complete the form accurately.

- Press the ‘Get Form’ button to access the Dreyfus Inherited IRA form and open it in your preferred online editor.

- Fill out the account information section. Provide the IRA owner's name, account number, social security number, and the date of death in the specified format.

- Complete the beneficiary information section. Enter your name, relationship to the IRA owner, date of birth, social security number, and address details including city, state, and ZIP code.

- Indicate your beneficiary relationship by selecting the appropriate option: spouse beneficiary, non-spouse beneficiary, or executor of the estate.

- Select your distribution option due to the IRA owner's death. Choose from treating the IRA as your own, life expectancy, five-year rule, or lump sum distribution.

- If applicable, indicate whether the required minimum distribution (RMD) has been met for a Traditional IRA or non-spouse Roth IRA. Make your selection accordingly.

- Complete the federal income tax withholding election. Choose whether you want taxes withheld from the distribution or not, and specify a percentage if necessary.

- Sign the form in the designated area, certifying your Taxpayer Identification Number and related statements. Ensure the signature is guaranteed as required.

- After completing all sections, save your changes, and download or print the completed form to submit it as per the instructions provided.

Start filling out the Dreyfus Inherited IRA form online today for a hassle-free distribution request.

The new rule for inherited IRAs, effective since 2020, primarily changes how beneficiaries must withdraw funds. Under these regulations, many non-spouse beneficiaries must deplete the inherited IRA within ten years of the original account holder's death. This rule impacts financial planning strategies significantly, making it even more vital to complete the Dreyfus Inherited Ira Form correctly and on time. Platforms like uslegalforms can assist you in navigating these new requirements effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.