Loading

Get Tc106s 2014 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tc106s 2014 Form online

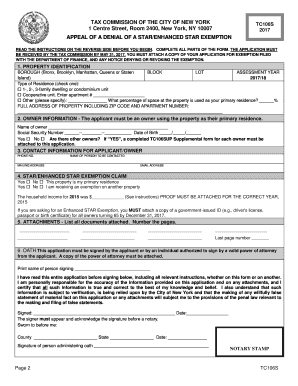

Filling out the Tc106s 2014 Form online is a crucial step for those appealing a denial of a STAR exemption. This guide will provide clear and supportive instructions for completing each section of the form to ensure a smooth submission process.

Follow the steps to complete the Tc106s 2014 Form online.

- Click the ‘Get Form’ button to obtain the form and open it in the designated editor.

- In Section 1, enter the property identification details. Select the borough from the options provided (Bronx, Brooklyn, Manhattan, Queens, Staten Island), and input the block and lot numbers. Specify the assessment year as 2012/13 and indicate the type of residence by checking the appropriate box and providing any required details, such as unit number and shares for cooperative housing.

- In Section 2, fill out the applicant's information. Provide the full name of the applicant, social security number, and date of birth. Ensure that this information accurately reflects the owner using the property as their primary residence.

- Section 3 requires contact information. Record the phone number, name of the person to be contacted, mailing address, and email address for any correspondence related to the appeal.

- Complete Section 4 for basic STAR exemption claim. Confirm that the property is your primary residence by marking ‘Y’ or ‘N’. Insert your household income for the year 2010, making sure to attach proof as required, as the appeal will not be reviewed without this documentation.

- For Section 5, provide similar information for the enhanced STAR exemption claim. Mark whether the property is a primary residence and enter the household income for 2010. Also, remember to attach a copy of a government-issued ID if applicable.

- In Section 6, list any attachments that serve as proof, numbering the pages accordingly.

- Section 7 contains the oath. The application must be signed by an individual who has personal knowledge of the details provided. Print the name of the person signing and ensure their signature, date, and acknowledgment by a notary are included.

- Once all sections are completed, review the form for accuracy, save your changes, and prepare to submit. You may choose to download or print the form for your records before sharing it as directed in the filing instructions.

Start filling out your Tc106s 2014 Form online today to ensure your appeal is submitted on time.

Related links form

Filling out Form ST 120 requires you to provide specific information about your transactions and the purpose for exemption from sales tax. Begin by carefully reading the instructions provided with the form to ensure accurate completion. If you are unsure or require guidance, the Tc106s 2014 Form can offer valuable insights into similar processes, allowing you to handle your tax filings more effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.