Loading

Get Fill-in Form - Uncle Fed's Tax*board

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fill-in Form - Uncle Fed's Tax*Board online

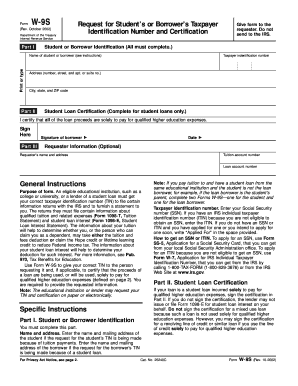

This guide provides a detailed walkthrough for filling out the Fill-in Form - Uncle Fed's Tax*Board, ensuring you complete each section accurately and confidently. Follow these instructions to successfully provide the necessary information for your tax-related needs.

Follow the steps to complete the form efficiently.

- Click the ‘Get Form’ button to access the form and open it in your preferred online editor.

- In Part I, provide the name of the student or borrower. If you are submitting the form for tuition payments, enter the name of the student. If it is for a student loan, enter the name of the borrower. Ensure that the name is clearly printed or typed.

- Fill in the taxpayer identification number (TIN), which is necessary for processing. Enter your Social Security number. If you do not have an SSN but possess an IRS individual taxpayer identification number (ITIN), include that instead. If you have applied for an SSN or ITIN, indicate 'Applied For' in the appropriate space.

- Provide the address, including the street number, apartment or suite number, city, state, and ZIP code, in the designated fields.

- In Part II, if your loan is exclusively for qualified higher education expenses, sign the certification. Note that if you do not sign, the lender may not process Form 1098-E for student loan interest.

- Be aware that you should only sign for student loans used solely for educational expenses. Mixed-use loans should not be certified.

- Part III is optional. If you wish to provide additional information for the requester, include the requester’s name, address, and relevant account numbers.

- After filling out the form, review all entries for accuracy and completeness. Once confirmed, you can save changes to your document, download it for your records, print a hard copy, or share it with the requester as needed.

Complete your tax documents online today to ensure timely processing and compliance.

Some of the biggest tax mistakes include disregarding eligibility for tax credits, forgetting to report income, and failing to keep proper documentation. These oversights can lead to missed refunds or issues with the IRS. Using the Fill-in Form - Uncle Fed's TaxBoard can help you avoid these pitfalls and ensure that you take full advantage of all available tax benefits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.