Get Application For Class 4c3ii Non Profit Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Class 4c(3)(ii) Non-Profit Form online

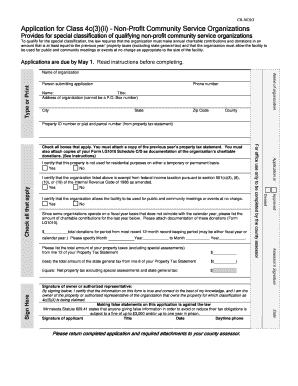

Filling out the Application For Class 4c(3)(ii) Non-Profit Form online can seem daunting, but this guide will provide you with clear, step-by-step instructions to help you complete the application accurately. This form is essential for qualifying non-profit community organizations seeking classification benefits.

Follow the steps to successfully complete your application.

- Click ‘Get Form’ button to access the application and open it in your editor.

- Complete the section identifying the person submitting the application. Enter the name of the organization, contact phone number, and the name and title of the individual submitting the form. Ensure all provided details are accurate to avoid any processing delays.

- Fill in the address of the organization, including the city, state, and zip code. Note that the address must not be a P.O. Box.

- Enter the Property ID number or the plat and parcel number as indicated on your property tax statement. This is crucial for linking the application to the correct property.

- Indicate whether the organization meets the charitable contributions requirement by checking all applicable boxes. Provide the total donations for the last year, specifying the timeframe, and attach relevant documentation (Form LG1010).

- Calculate the net property tax by deducting the state general tax from your total property tax (exclusive of special assessments). Record this amount clearly.

- Sign and date the application, certifying the truthfulness of the information by the owner or authorized representative of the organization.

- Ensure all required attachments are included: previous year’s property tax statement and Form LG1010 documentation. This is necessary for the application to be considered complete.

- Submit the completed application to your county assessor by the due date of May 1. Retain a copy for your records.

Start completing your Application For Class 4c(3)(ii) Non-Profit Form online today to take advantage of valuable classification benefits!

Setting up a 501c3 can take a few weeks to several months depending on the complexity of your organization. To expedite the process, ensure you have all required paperwork ready, including the Application For Class 4c3ii Non Profit Form. With a clear mission and organized documents, you may complete the set-up quickly, but remember that the IRS review process will still require time.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.