Get Nyc 3360 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nyc 3360 2010 online

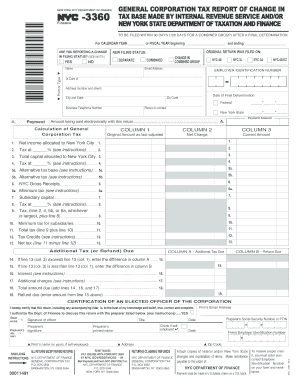

Filing the Nyc 3360 2010 form is an essential step for reporting changes in your corporation's tax base as determined by the Internal Revenue Service or the New York State Department of Taxation and Finance. This guide will provide you with clear, step-by-step instructions to complete this form online with confidence.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to obtain the Nyc 3360 2010 form and open it in your preferred editor.

- Begin by entering the calendar year or fiscal year for which you are filing the form in the designated space.

- Indicate whether you are reporting a change in filing status by selecting 'YES' or 'NO'. Ensure to check the appropriate box.

- Complete the sections for your business name, email address, Employer Identification Number, and contact information accurately.

- Enter the date of the final determination and original return details, selecting the appropriate return type that was previously filed.

- Populate the Calculation of General Corporation Tax section carefully, filling in the necessary columns with accurate figures for net income and tax calculations.

- Attach any required documentation, including a copy of the final IRS or New York State adjustment notice, if applicable.

- Verify all entered data for accuracy before moving on to the certification section.

- Complete the certification section by having an authorized officer sign and date the form. Include the preparer's information if applicable.

- Once all sections are complete, utilize the options available to save changes, download the form, or print it for your records.

Complete your Nyc 3360 2010 form online today to ensure compliance and accuracy in your tax reporting.

NYC 204EZ can be filed by small business owners who meet specific criteria, such as those with uncomplicated income sources and who do not have tax liabilities exceeding a certain threshold. It is designed for simplicity, allowing solo proprietors or partnerships to report their income with ease. To determine your eligibility and navigate the filing process, USLegalForms offers useful insights and templates to help with NYC 3360 2010 documentation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.