Get Nonresident Alien Questionnaire Form Part Ii: U.s. L - Naz

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nonresident Alien Questionnaire Form PART II: U.S. L - Naz online

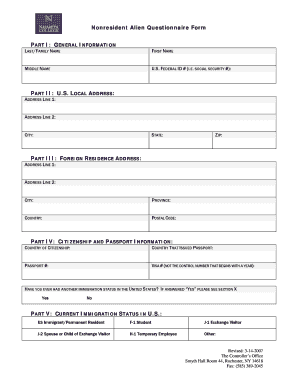

Filling out the Nonresident Alien Questionnaire Form can be a crucial step for individuals navigating their immigration status in the United States. This guide provides a clear, step-by-step approach to completing Part II of the form online, ensuring you understand each section and field.

Follow the steps to accurately complete your form.

- Press the ‘Get Form’ button to access the Nonresident Alien Questionnaire Form and open it in the editor.

- In Part I: General Information, enter your last/family name, first name, and middle name in the designated fields. Additionally, provide your U.S. federal identification number, such as your social security number.

- Move to Part II: U.S. Local Address. Fill in your address details accurately, including address line 1, address line 2 (if applicable), city, state, and zip code.

- For Part III: Foreign Residence Address, provide your address in your home country. This includes filling out address line 1, address line 2 (if necessary), city, province, country, and postal code.

- In Part IV: Citizenship and Passport Information, indicate your country of citizenship, the country that issued your passport, and input your passport number along with your visa number. Remember to answer whether you have ever had another immigration status in the United States.

- Proceed to Part V: Current Immigration Status in the U.S. Select your current immigration status from the provided options, such as F-1 Student or J-1 Exchange Visitor.

- If your immigration status is J-1, complete Part VI by selecting the appropriate subtype of J-1 status you possess.

- In Part VII, identify the actual primary activity of your visit to the U.S. Choose the option that best reflects your primary activity.

- In Part VIII, fill out the entry and activity dates with the specific dates of your entry into the United States and the start and projected end dates of your immigration status or primary activity.

- In Part IX, list your income providing activity, such as your role or title if applicable.

- For Part X, record any visits you have made to the U.S. in the last three calendar years, providing the dates of entry and exit, visa status, primary activity, and whether you have taken any treaty benefits.

- Finally, complete Part XI: Certification by confirming that all the provided information is true and correct. Sign and date the form, and include your local phone number and email.

- Review your completed form for accuracy. Once satisfied, you can save changes, download, print, or share the form.

Complete your Nonresident Alien Questionnaire Form online to ensure a smooth immigration process.

The primary IRS form for a nonresident alien is Form 1040NR, which is used to report U.S.-sourced income and taxable earnings. This form is designed to facilitate tax compliance for individuals who do not meet residency requirements. You can find assistance through the Nonresident Alien Questionnaire Form PART II: U.S. L - Naz, which guides users through the filing process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.