Loading

Get Form Nyc 1127 2006

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form NYC 1127 2006 online

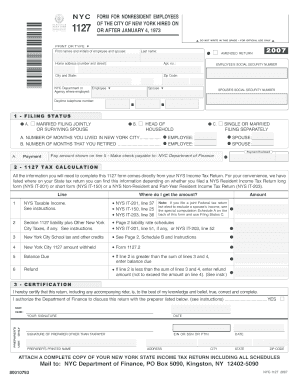

This guide provides comprehensive instructions for users on how to fill out the Form NYC 1127 2006 online. Designed for nonresident employees of the City of New York, these outlined steps ensure an accurate and efficient completion of the form.

Follow the steps to complete the Form NYC 1127 2006 online.

- Click the ‘Get Form’ button to obtain the form and open it in your editor.

- Fill in your first names and initials, along with your last name and home address in the specified fields.

- Indicate your filing status by selecting one of the options provided, including options for single, married filing jointly, or head of household.

- Enter your social security number and your daytime telephone number in the relevant fields.

- Proceed to the tax calculation section, where you will refer to your New York State income tax return to gather necessary information for lines 1 to 6.

- Complete the certification section by signing and dating the form, ensuring all information is truthful and complete.

- After completing the form, remember to attach a complete copy of your New York State income tax return and any required tax statements, then save changes.

- Download, print, or share the completed form as needed for submission to the NYC Department of Finance.

Complete your Form NYC 1127 2006 online today to ensure timely and accurate tax compliance.

You can obtain your 1095-A form online in New York by logging into your Health Insurance Marketplace account. It is typically available by early February following the tax year. If you enrolled in a health plan through the marketplace during 2006, this form should be accessible to help with your Form NYC 1127 2006 submission. Always check your account for the latest updates regarding your documents.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.