Loading

Get It 1040 X Ohio Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the It 1040 X Ohio Form online

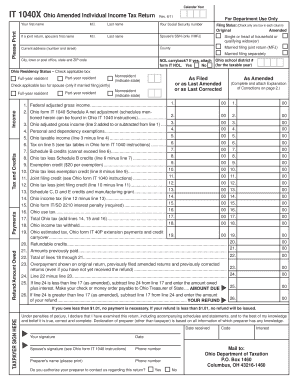

The It 1040 X Ohio Form is used to amend an individual income tax return in Ohio. This guide provides step-by-step instructions to assist users in completing the form online, ensuring a smooth filing process.

Follow the steps to complete your It 1040 X Ohio Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your first name, middle initial, and last name in the designated fields.

- Input your Social Security number to identify your tax records.

- Select your filing status by checking only one box in each column.

- If applicable, provide your spouse's first name, middle initial, last name, and Social Security number.

- Fill in your current address, including street number and name, city or town, county, state, and ZIP code.

- Indicate if you have an NOL carryback by checking the yes or no box.

- Select your Ohio residency status by checking the appropriate box.

- Complete lines for federal adjusted gross income, Ohio adjustments, and Ohio taxable income as instructed.

- If applicable, enter any tax credits, exemptions, and calculate your total Ohio tax.

- Review all entries for accuracy and completeness. Ensure that any required additional documentation is attached.

- At the final stage, save your changes, download, print, or share the form as needed.

Get started with your It 1040 X Ohio Form online today.

Yes, you can file an Ohio amended return electronically using various tax preparation software, which often simplifies the process. Make sure to select the It 1040 X Ohio Form for this purpose. Check with your software provider for specific instructions to ensure a smooth filing experience.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.