Loading

Get Sc Revenue Ruling 09 13

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC Revenue Ruling 09-13 online

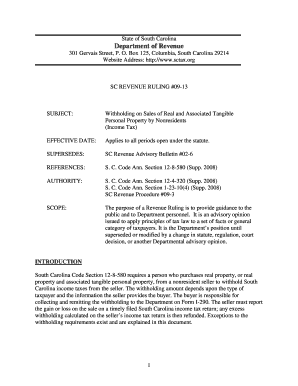

This guide provides a comprehensive overview of how to complete the SC Revenue Ruling 09-13 form online. It is designed to assist users in navigating the various sections and fields of the form effectively.

Follow the steps to complete the SC Revenue Ruling 09-13 form online.

- Press the ‘Get Form’ button to access the form and open it in your editor.

- Begin by entering the seller's information, including their name, address, and social security number, in the designated fields.

- Indicate the closing date of the sale in the specified section. This date is crucial for accurate tax calculations.

- In the affidavit portion, confirm whether the seller is a resident or deemed resident of South Carolina by checking the appropriate box.

- If applicable, provide details regarding the seller's tax-exempt status or any special conditions that apply to the sale.

- Specify the gain amount if applicable, ensuring that it does not exceed the calculated maximum gain for the transaction.

- In cases of installment sales or like-kind exchanges, include any necessary information about the payment structure or intended tax deferral plans.

- Review all entered information for accuracy before finalizing the form. Make sure all required fields are completed to avoid processing delays.

- Upon completion, save the changes made to the form. You can then download, print, or share the form as necessary.

Start completing your documents online today to ensure compliance and facilitate timely processing.

Related links form

South Carolina does not impose an inheritance tax, which means residents do not need to obtain a waiver. Beneficiaries can inherit property without the burden of state inheritance taxes, simplifying the process. For families navigating estate issues, it's wise to consult resources like the Sc Revenue Ruling 09 13 for additional insights.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.