Loading

Get State Of South Dakota Form W 9

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the State Of South Dakota Form W 9 online

Filling out the State Of South Dakota Form W 9 online can simplify the process of providing your taxpayer information. This guide will walk you through each component of the form to ensure that you complete it accurately and efficiently.

Follow the steps to complete the form correctly.

- Click ‘Get Form’ button to access the form and open it in the online editor.

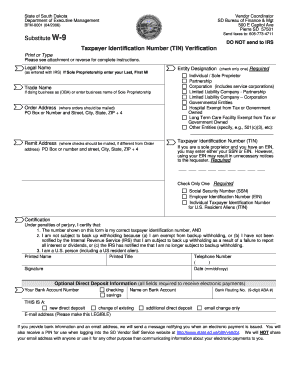

- Enter your legal name exactly as it appears with the IRS. If you are a sole proprietor, include your last name, first name, and middle initial.

- If applicable, fill in the trade name, which is the name you are doing business under if it differs from your legal name.

- Provide the order address where orders should be mailed, including the PO Box or street address, city, state, and ZIP code.

- If your remit address is different from the order address, enter that information as well.

- Select your entity designation by checking only one box that accurately describes your business entity type.

- Input your taxpayer identification number (TIN). You can select either your Social Security Number (SSN), Employer Identification Number (EIN), or Individual Taxpayer Identification Number (ITIN). Ensure to list only one of these options.

- Review and complete the certification section. This section includes a statement of compliance under penalties of perjury. Ensure that you meet the requirements stated here.

- Provide additional information as necessary, including printed name, title, telephone number, signature, and date.

- Optional: If you wish to receive electronic payments, complete the direct deposit information, including your bank account and routing numbers. You may also provide an email address for payment notifications.

- Once all sections are completed and reviewed, you can save changes, download the form, print it, or share it as required.

Complete your State Of South Dakota Form W 9 online today for a smooth and efficient process.

When filling out the State Of South Dakota Form W 9, the '0' or '1' typically refers to exemptions from backup withholding. If you are not subject to backup withholding, you should leave that section blank or put '0'. Conversely, if you are subject, provide '1'. Ensure you understand your tax status, and consider consulting US Legal Forms for further clarity on these details.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.