Get Sep Summary For Employees - Optionshouse

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SEP Summary For Employees - OptionsHouse online

This guide provides clear instructions for completing the SEP Summary for Employees - OptionsHouse online. By following these steps, users can navigate the form effectively and understand its key components.

Follow the steps to fill out the SEP Summary for Employees - OptionsHouse online.

- Press the ‘Get Form’ button to acquire the SEP Summary for Employees - OptionsHouse document.

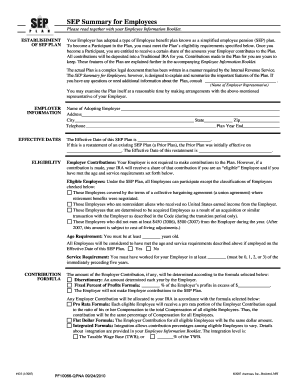

- Fill in the employer information section, which includes the name of the adopting employer, address, city, state, zip code, and telephone number.

- Specify the effective date for the SEP plan. If applicable, include the prior plan's effective date and the effective date of the restatement.

- Complete the eligibility section by defining the age requirement and service requirement for employees who will participate in the plan.

- Select the employer contribution formula. Choose between discretionary contributions or a fixed percentage of profits formula, and fill in the necessary details if applicable.

- Decide on the allocation formula for employer contributions, selecting from pro rata, flat dollar, or integrated formulas based on your company's requirements.

- Provide information regarding compensation definitions and select the plan year for your SEP plan. Specify the 12-month period for contributions.

- Review the entire document to ensure all sections are complete and accurate before proceeding to the signature section.

- An authorized representative of the employer must sign and date the document to finalize the adoption agreement.

- Once completed, save your changes and download, print, or share the SEP Summary for Employees as needed.

Complete your documents online today for efficient management of your SEP plan.

Setting up a SEP for your employees involves a few straightforward steps. First, choose a financial institution to serve as the trustee for the SEP plan. Afterward, complete the necessary paperwork, such as Form 5305 SEP, and explain the SEP Summary For Employees - OptionsHouse to your employees so they understand their benefits. Finally, make contributions on behalf of your employees, which will be tax-deductible for you and can help secure their financial future.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.