Loading

Get Fillable Wt 11

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fillable Wt 11 online

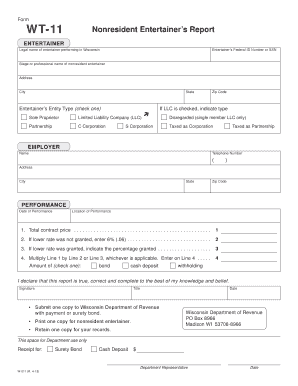

The Fillable Wt 11 form is essential for nonresident entertainers performing in Wisconsin. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the Fillable Wt 11 online

- Click the 'Get Form' button to access the Fillable Wt 11 form and open it in your preferred editing tool.

- In the 'Entertainer' section, input the legal name of the entertainer performing in Wisconsin. Provide the entertainer's Federal ID number or Social Security Number, followed by their stage or professional name.

- Fill in the address fields: street address, city, state, and zip code. Select the entertainer's entity type by checking the appropriate box (sole proprietor, LLC, partnership, C corporation, or S corporation). If 'LLC' is selected, indicate the type of LLC.

- Move to the 'Employer' section and enter the employer's name, telephone number, and address details.

- In the 'Performance' section, record the date and location of the performance.

- Enter the total contract price in the designated line, then proceed to check if a lower rate was granted. If not, enter 6% (0.06) in the next line; otherwise, indicate the percentage granted.

- Calculate the amount for Line 4 by multiplying Line 1 by Line 2 or Line 3, as applicable.

- Check the appropriate box for the amount being reported (bond, cash deposit, or withholding).

- Finally, ensure to sign the declaration, add your title, and date the report. Review all entries for accuracy.

- To complete the process, submit one copy to the Wisconsin Department of Revenue, print one copy for the entertainer, and retain one for your records.

Complete your Fillable Wt 11 online today for a seamless submission experience!

You can easily access the Fillable Wt 11 on the US Legal Forms website. Just navigate to the tax forms section, and you will find a range of fillable forms, including Form 11. Whether you need it for personal use or business, you can download it instantly and start filling it out.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.