Loading

Get Form W-9 (rev. October 2007) - Csuf Asc - Csufasc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form W-9 (Rev. October 2007) - CSUF ASC - Csufasc online

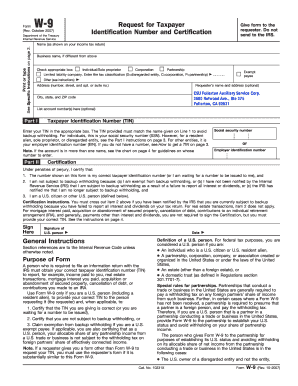

Filling out the Form W-9 is an essential step for individuals and entities to provide their taxpayer identification information to requesters. This guide will offer you clear, step-by-step instructions on how to accurately complete the Form W-9 online, ensuring that your information is correctly submitted and processed.

Follow the steps to successfully complete the Form W-9.

- Click the 'Get Form' button to obtain the W-9 form and open it in your preferred editor.

- In the first section, provide your name exactly as it appears on your income tax return. If you have a business name that differs, include it in the next field.

- Select the appropriate classification for your entity by checking the corresponding box, such as Individual/Sole Proprietor, Corporation, Partnership, or Limited Liability Company. If applicable, enter the tax classification next to the LLC option.

- Enter your complete address, including the street name, number, and any apartment or suite number, followed by the city, state, and ZIP code.

- In Part I, provide your Taxpayer Identification Number (TIN). For individuals, this will typically be your Social Security Number (SSN). If your entity has an Employer Identification Number (EIN), enter it accordingly.

- Navigate to Part II and certify the accuracy of your information by confirming that the TIN you provided is correct, as well as indicating if you are subject to backup withholding.

- Sign and date the form in the designated area to validate the information you have provided. Make sure your signature corresponds with the name shown in Part I.

- Finally, review your completed form for accuracy, then save your changes, download a copy, print it, or share the completed form with the requester.

Complete your Form W-9 online now to ensure your tax information is accurately provided.

If a company fails to provide you with a Form W-9 (Rev. October 2007) - CSUF ASC - Csufasc, you may be unable to report the payments made to them accurately. This can lead to tax complications for both parties. To ensure compliance, consider using platforms like uslegalforms to guide you on proper documentation processes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.